A Portfolio Management Service (PMS) is a specialized platform designed for high-net-worth individuals, offering tailored investment solutions to meet their financial objectives. There are three approaches to managing investments within a PMS: Discretionary Portfolio, Non-Discretionary Portfolio, and Advisory Portfolio.

Portfolio Management Services fall under the regulatory oversight of the Securities and Exchange Board of India (SEBI), following the PMS Regulations.

The minimum investment amount required to open a new PMS account aligns with the regulatory standard, set at Rs. 50 lakhs.

Portfolio Management Services (PMS)

Consistent Compounders : Marcellus’ Consistent Compounders PMS invests in a concentrated portfolio of heavily moated companies that can drive healthy earnings growth over long periods of time

MeritorQ PMS : Marcellus’ MeritorQ PMS takes a rules-based approach to screen for companies with low leverage, consistent profitability and which pass the Marcellus’s quantitative forensic accounting framework.

Little Champs: Marcellus Little Champs is our small-cap focused strategy. On an average over the last ten years, about ~50 stocks have entered/exited BSE 500 every year indicating a high degree of churn.

Kings of Capital : The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 high quality Financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation and high barriers to entry.

Rising Giants : High quality mid-sized companies have been amongst the biggest wealth creators in Indian equities over the last 3, 5 and 10 years.Marcellus Rising Giants PMS intends to identify and invest in such high quality mid-sized companies.

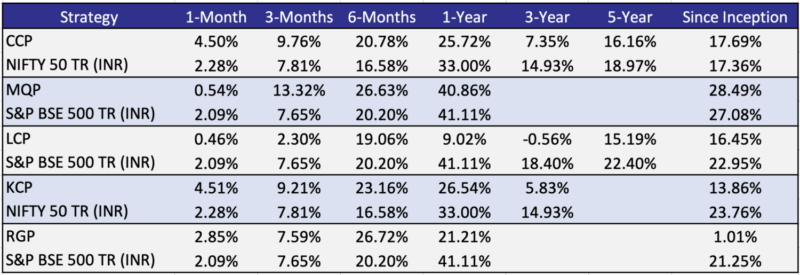

Performance Snapshot vis-à-vis Respective Benchmarks (figures in %)

As of 30th September 2024

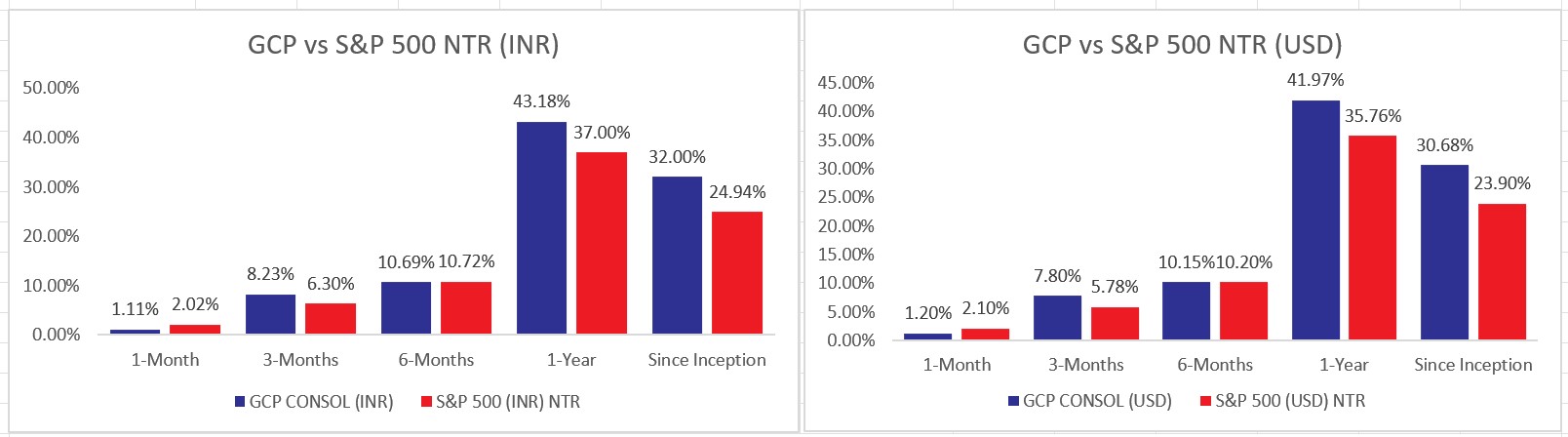

Global Compounders : Marcellus’ Global Compounders Portfolio (GCP) invests in 20-30 deeply moated global companies based on rigorous bottom-up research around moats, capital allocation and sustainability of cash generation into the long-term future.

Performance

Performance as on 30th September 2024 (figures in %)

Marcellus performance data is shown gross of taxes and net of fees and expenses charged until the end of last month. Performance fees are charged annually in December. Returns for periods longer than one year are annualized. Marcellus’ GCP USD returns are converted into INR using exchange rate published by RBI. Source: https://www.rbi.org.in/scripts/ReferenceRateArchive.aspx

‘Since Inception’ performance calculated from 31st Oct 2022. The inception date is 31st October 2022, being the next business day after the account got funded on 28th October 2022. S&P 500 net total return is calculated by considering both capital appreciation and dividend payouts.

Contact us for your wealth management and more information.

Email: pramod.gamare@hotmail.com

Phone: 7559411986