In today’s rapidly evolving financial landscape, securing your financial future through effective planning is more crucial than ever. Financial planning and wealth management aren’t just for the wealthy; they’re vital for anyone aiming to achieve long-term financial security and stability. In this guide, we’ll walk through the essential steps of financial planning, explore the core principles of wealth management, and provide practical tools to help you make informed decisions.

__________________________________________________________________________________

1. What is Financial Planning?

Financial planning is the process of assessing your current financial situation and creating a roadmap to meet your future financial goals. Whether you’re planning for retirement, saving for your child’s education, or managing debt, financial planning helps ensure you’re on the right path.

Key Components of Financial Planning:

- Budgeting: Tracking your income and expenses to ensure you’re living within your means.

- Saving: Establishing an emergency fund and saving for future goals.

- Debt Management: Paying off loans and credit cards effectively to reduce financial stress.

- Investment: Allocating resources in assets like stocks, bonds, or real estate to grow wealth over time.

- Retirement Planning: Setting up savings plans like IRAs or 401(k)s to secure your future.

__________________________________________________________________________________

2. Why is Financial Planning Important?

Without a clear financial plan, it’s easy to fall into a cycle of financial uncertainty, which can prevent you from achieving your life goals. Here’s why proper financial planning matters:

- Personal Financial Security: A well-structured plan ensures you’re prepared for both expected and unexpected life events.

- Achieving Financial Goals: Whether you’re saving for a home, vacation, or retirement, a financial plan helps you stay on track.

- Reducing Financial Stress: With a plan in place, you’re less likely to face financial crises or make poor financial decisions during emergencies.

By organizing your financial life, you can take control of your future and ensure long-term financial stability.

__________________________________________________________________________________

3. Steps to Effective Financial Planning

A comprehensive financial plan involves several key steps:

Budgeting:

Start by tracking your income and expenses to get a clear understanding of where your money is going. Free tools like Mint or YNAB can help you manage your cash flow.

Building an Emergency Fund:

Aim to save three to six months’ worth of living expenses to protect yourself against unexpected events, such as job loss or medical emergencies.

Debt Management:

Focus on paying off high-interest debt, like credit cards, as soon as possible. Consolidation and refinancing options may also help reduce your monthly payments.

Retirement Planning:

Invest in retirement accounts such as IRAs or 401(k)s early to take advantage of compound interest. Regular contributions will help you build a nest egg for your golden years.

Investment Planning:

Investing your money in stocks, bonds, mutual funds, or real estate can help grow your wealth. Diversification is key—don’t put all your eggs in one basket.

__________________________________________________________________________________

4. Introduction to Wealth Management

While financial planning focuses on your immediate and future financial stability, wealth management takes a broader view. Wealth management involves managing your investments, estate, taxes, and overall financial portfolio in a strategic way to build and protect long-term wealth.

What Does Wealth Management Involve?

- Investment Strategies: Wealth managers help build personalized portfolios based on your risk tolerance, time horizon, and financial goals.

- Estate Planning: Ensuring your assets are passed on to your beneficiaries according to your wishes, often through wills, trusts, or charitable donations.

- Tax Optimization: Minimizing your tax liability through strategic tax planning, charitable giving, and investment choices.

Wealth management is typically more relevant for individuals who have accumulated significant assets, but its principles can be useful at any stage of financial growth.

__________________________________________________________________________________

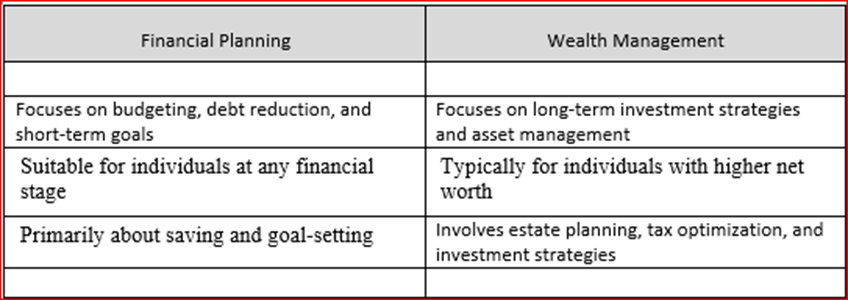

5. The Difference between Financial Planning and Wealth Management

While financial planning focuses on budgeting, savings, and meeting immediate goals, wealth management is a more comprehensive approach. Here’s how they differ:

Both financial planning and wealth management are critical to achieving long-term financial success. Whether you’re starting out or managing a large portfolio, each plays an important role in your overall financial health.

__________________________________________________________________________________

6. Building an Effective Wealth Management Strategy

For those looking to grow and protect their wealth, an effective wealth management strategy involves several components:

Investment Planning:

Diversifying your investments across multiple asset classes (stocks, bonds, real estate) helps manage risk and optimize returns.

Estate Planning:

Create wills and trusts to ensure that your wealth is transferred smoothly to your beneficiaries. Estate planning also helps reduce estate taxes and legal complications.

Tax Efficiency:

Utilize tax-deferred accounts, charitable donations, and other strategies to minimize your taxable income and maximize your wealth.

Risk Management:

Wealth managers often advise clients on how to mitigate risks through insurance, annuities, and asset protection strategies.

__________________________________________________________________________________

7. Tools and Resources for Financial Planning and Wealth Management

Fortunately, there are many tools and resources available to simplify the process of financial planning and wealth management:

- Budgeting Apps: Tools like Mint, YNAB (You Need a Budget), and Personal Capital allow you to easily track income and expenses.

- Robo-Advisors: Platforms like Betterment and Wealth front automate investment decisions based on your risk tolerance and goals.

- Financial Advisors: For those with more complex financial situations, a certified financial planner (CFP) or wealth manager can offer personalized advice.

Using these tools helps streamline your financial planning efforts and ensures you have the information you need to make informed decisions.

__________________________________________________________________________________

8. Common Mistakes to Avoid in Financial Planning

Even the most meticulous financial plans can be derailed by a few common missteps. Here’s how to avoid them:

- Neglecting an Emergency Fund: Failing to save for emergencies can force you to rely on debt when the unexpected happens.

- Lack of Diversification: Over-investing in one asset class can lead to higher risk and less stable returns.

- Ignoring Inflation: Not accounting for inflation can reduce the purchasing power of your savings over time.

- Failure to Adjust Plans: Life changes, such as marriage, a new job, or having children, require updates to your financial plan.

__________________________________________________________________________________

Conclusion

Financial planning and wealth management are essential practices for building a secure financial future. Whether you’re just starting your financial journey or managing substantial assets, having a clear, personalized strategy is key to long-term success. By following these steps and utilizing available resources, you’ll be well on your way to achieving your financial goals and protecting your wealth for generations to come.

Take action today—start planning for your financial future, or consult a wealth manager to help grow and protect your assets.

Contact us for your wealth management and more information.

Email: pramod.gamare@hotmail.com

Phone: 7559411986

__________________________________________________________________________________

Post Disclaimer

Disclaimer

1. The Alpha Wealth is a wealth advisory offering financial services viz and third-party wealth management products. The details mentioned in the respective product/ service document shall prevail in case of any inconsistency with respect to the information referring to BFL products and services on this page.

2. All other information, such as, the images, facts, statistics etc. (“information”) that are in addition to the details mentioned in the The Alpha Wealth product/ service document and which are being displayed on this page only depicts the summary of the information sourced from the public domain. The said information is neither owned by The Alpha Wealth nor it is to the exclusive knowledge of The Alpha Wealth. There may be inadvertent inaccuracies or typographical errors or delays in updating the said information. Hence, users are advised to independently exercise diligence by verifying complete information, including by consulting experts, if any. Users shall be the sole owner of the decision taken, if any, about suitability of the same.

Standard Disclaimer

Investments in the securities market are subject to market risk, read all related documents carefully before investing.

Research Disclaimer

Sub-Broking services offered by Sharekhan LTD | REG OFFICE: Badlapur, Thane 421503. Corp. Office: ---, Maharashtra 421503. SEBI Registration No.: --| BSE Cash/F&O/CDS (Member ID:--) | NSE Cash/F&O/CDS (Member ID: --) | DP registration No: --- | CDSL DP No.: --| NSDL DP No. --| AMFI Registration No.: ARN –253455.

Website: https://thegreenbackboogie.com//

Research Services are offered by The Alpha Wealth as Research Analyst under awaiting SEBI Registration No.: ---.

Details of Compliance Officer: -- | Email: --/ --- | Contact No.: -- |

This content is for educational purpose only.

Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment.

29 thoughts on “The Comprehensive Guide to Financial Planning and Wealth Management”