Historically, the role of gold and other precious metals in terms of volatility (as measured by the Volatility Index (VIX)) as a hedge (negatively correlated with stocks) and safe haven (negatively correlated with stocks in the event of sharp stock market drops) was examined using data from the US stock market gold serves as a strong hedge against volatility in times of global uncertainty. Gold is generally considered to be a good hedge against inflation.

It is also considered to be a safe haven when equity markets go into a tailspin. With such a high demand for alternative currencies for transactions, gold has grown its importance. Be skeptical of claims that gold or the US currency is becoming less relevant. Foreign exchange reserves are made up of gold, special drawing rights, foreign currency assets, and reserve tranche positions in the IMF.

The price of gold and the state of the economy are inversely correlated. Due to the current banking instability and concern over a recession, investors proceed with caution when placing wagers on risky assets. Due to this investment in gold, which is historically regarded as a stable and secure asset, gold reached a new all-time high on 04th May 2023 as a result of expectations that the US Federal Reserve would comment on a rate pause.

As geopolitical uncertainties, such as the conflict in Ukraine, drive central bankers who oversee trillions in foreign exchange reserves to reconsider their investment strategy, they have begun stockpiling gold.

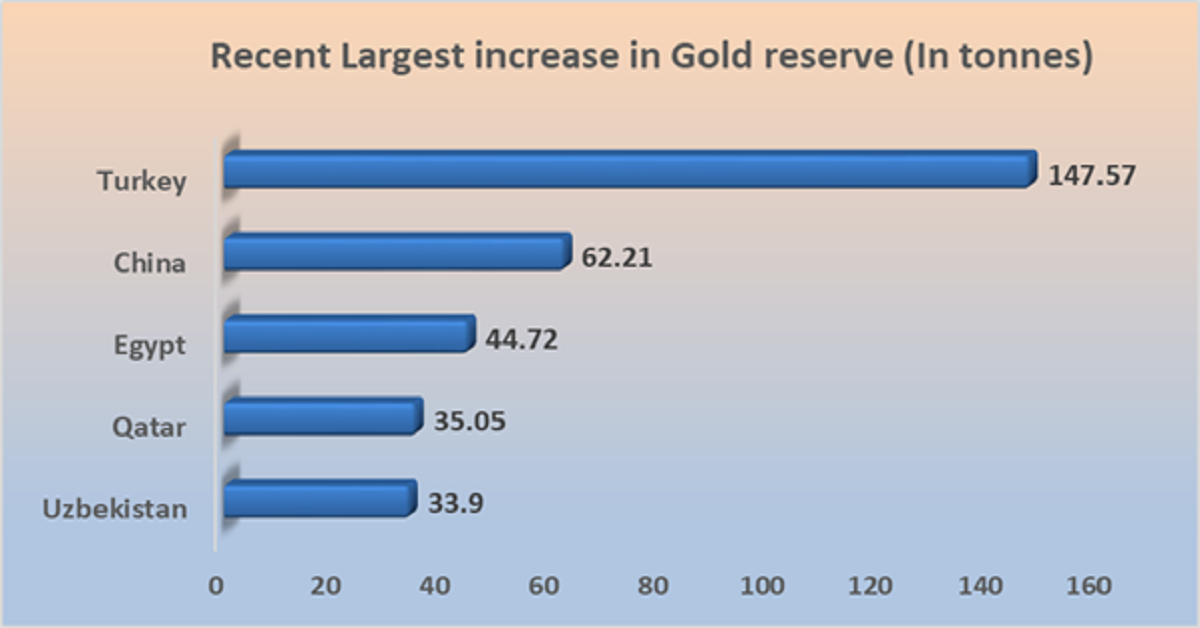

Gold has traditionally played a significant role in countries’ foreign exchange reserves. The top five countries that led the gold-buying rush between March 2022 and March 2023 had their central banks’ highest level of gold purchases.

This chart was updated in February 2023 and reports data available at that time. Data: International Monetary Fund’s International Financial Statistics (IFS), February 2023 edition

The geopolitical risk was ranked as one of the main concerns by the majority of reserve managers in the HSBC Reserve Management Trends Survey, second only to rising inflation. More than two-thirds of respondents in a recent annual survey of 83 central banks thought that global central banks would keep increasing their gold holdings in 2023. These 83 central banks oversee foreign exchange assets worth $7 trillion in total.

The post-Ukraine War weaponization of economic sanctions was another step. As anticipated, the US, UK, EU, and Japan coalition imposed economic sanctions. The decision to freeze $300 billion in Russian foreign exchange reserves held in US dollar assets was completely unexpected.

For all central banks, that was a worrying decision because it created a precedent for freezing Russian FX reserves and threatened a store of the most liquid, traded, and widely recognized currency-asset. Following the Russian sanctions, gold reserves that are kept in the safe deposit boxes of central banks appeared to be considerably more appealing.

Ruchir Sharma mentions in a recent note that “often in the past, both the dollar and gold have been seen as havens, but now gold is seen as much safer”.

The World Gold Council’s most current statistics show that inflows into exchange-traded funds (ETFs) that are backed by actual gold persisted in April. Despite a 15-tonne increase in holdings, net inflows reached $824 million. Unexpectedly weak economic news raised recession fears in the market, decreasing Treasury yields and increasing demand for gold as a safe haven.

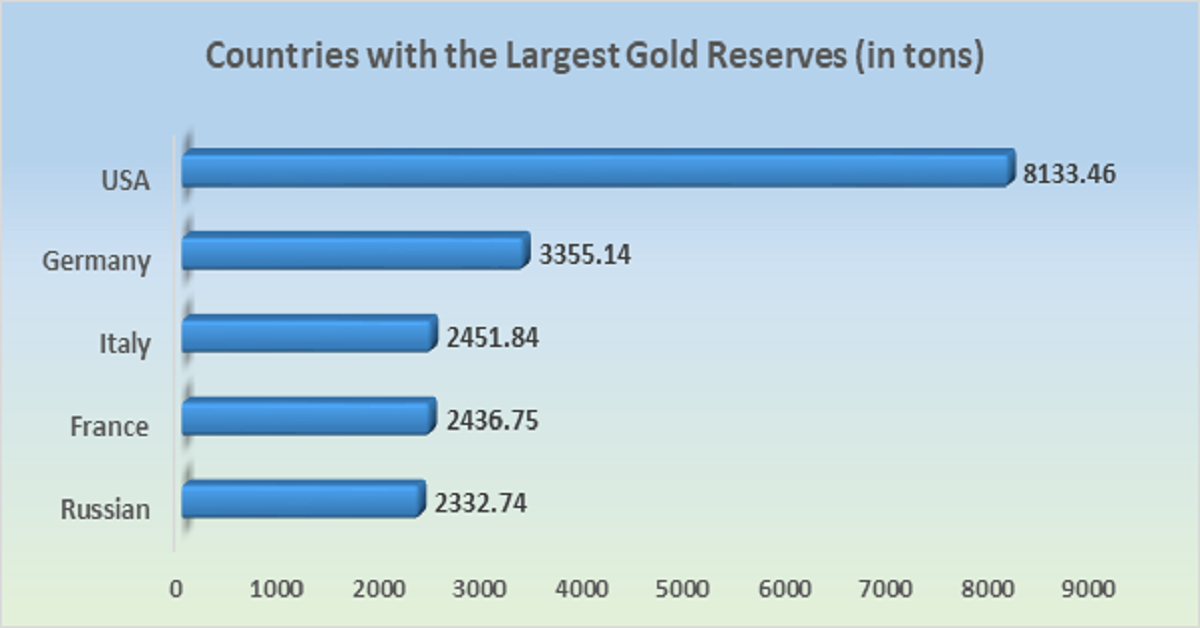

With more than 8,000 metric tonnes of gold, the United States is the country with the highest gold reserve. This was more than three times the gold holdings of Italy and France and more than twice the gold reserves of Germany. With 2332 tonnes of gold, the Central Bank of Russia now holds 24 percent of its gold reserves. China currently has over 62 tonnes of gold in its possession, bringing the total to over 2000 tonnes. Gold accounts for 33% of Turkey’s reserves.

This chart was updated in February 2023 and reports data available at that time. Data: International Monetary Fund’s International Financial Statistics (IFS), February 2023 edition

In a nutshell, the popularity of gold hedge against inflation will increase once the Fed and ECB finally decide to stop raising interest rates. Gold is unquestionably here to stay. The US-China rivalry, which will increase geopolitical volatility and make gold more alluring in an uncertain environment, adds to the metal’s shine.

Contact us for your wealth management and more information.

Email: pramod.gamare@hotmail.com

Phone: 7559411986

Post Disclaimer

Disclaimer

1. The Alpha Wealth is a wealth advisory offering financial services viz and third-party wealth management products. The details mentioned in the respective product/ service document shall prevail in case of any inconsistency with respect to the information referring to BFL products and services on this page.

2. All other information, such as, the images, facts, statistics etc. (“information”) that are in addition to the details mentioned in the The Alpha Wealth product/ service document and which are being displayed on this page only depicts the summary of the information sourced from the public domain. The said information is neither owned by The Alpha Wealth nor it is to the exclusive knowledge of The Alpha Wealth. There may be inadvertent inaccuracies or typographical errors or delays in updating the said information. Hence, users are advised to independently exercise diligence by verifying complete information, including by consulting experts, if any. Users shall be the sole owner of the decision taken, if any, about suitability of the same.

Standard Disclaimer

Investments in the securities market are subject to market risk, read all related documents carefully before investing.

Research Disclaimer

Sub-Broking services offered by Sharekhan LTD | REG OFFICE: Badlapur, Thane 421503. Corp. Office: ---, Maharashtra 421503. SEBI Registration No.: --| BSE Cash/F&O/CDS (Member ID:--) | NSE Cash/F&O/CDS (Member ID: --) | DP registration No: --- | CDSL DP No.: --| NSDL DP No. --| AMFI Registration No.: ARN –253455.

Website: https://thegreenbackboogie.com//

Research Services are offered by The Alpha Wealth as Research Analyst under awaiting SEBI Registration No.: ---.

Details of Compliance Officer: -- | Email: --/ --- | Contact No.: -- |

This content is for educational purpose only.

Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment.